There are many reasons to invest in an ETF. There are just as many reasons to launch one.

For starters, whether an investor or a product provider, this is an industry that has seen strong, continuous growth over the years. And everyone loves growth.

Since the first U.S.-listed ETF came to market in 1993, we’ve seen the number of products, ETF asset creations, and total assets (creation + market performance) plot a growth trendline that suggests further expansion in the longer-term.

Even in a year like 2022, when turbulent markets, high inflation and aggressive Fed policy have taken a toll on all asset class performances – to say nothing of investor nerves – we still have seen more than $500 billion in net asset creations through early November, and hundreds of new ETF launches. In the past 12 months we’ve tallied approximately 10% in product growth. (Latest ETF KPIs here)

Today, there are more than 3,070 ETFs listed on U.S. exchanges with just over $6.5 trillion in total assets.

Measuring the ETF Industry in an Index

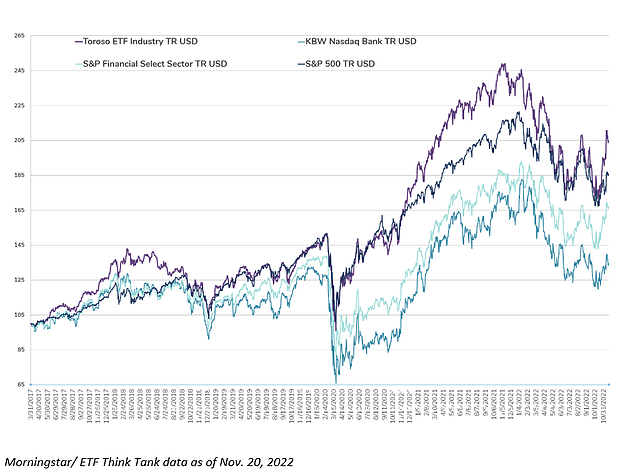

One way to take measure of the state of the ETF industry as a whole is through our proprietary Toroso ETF Industry Index (TETF), which we created in 2017. TETF is an index of 20 companies representing the ETF ecosystem, with names including BlackRock, Wisdomtree, Cboe Global Markets, Envestnet and Virtu.

TETF has been outperforming the broader financial sector, as measured by the SPDR Select Sector Financials ETF (XLF), since inception in 2017. If used as a measuring stick, you could argue that TETF’s relative performance (see chart below) suggests the ETF space has been a healthy, growing part of the financials sector.

So, what’s behind the success of the ETF wrapper? At the ETF Think Tank, we like to think of it as the direct result of the ETF structure’s many benefits to both client/investor and product provider.

Client Alignment Growth Factors

As an investor, the key drivers of ETF adoption are all hallmarks of the structure itself. Compared to other commingled funds, ETFs offer interesting benefits:

- Portfolio transparency – Most ETFs disclose holdings daily, and the information is publicly available across issuer websites and various channels.

- Low (or lower) cost – Relative to other investment products such as mutual funds, ETF fees are often much lower than other comparable strategies. (The cost bar has been lowered so significantly the market has already welcomed a couple of zero fee ETFs.)

- Liquidity – Intraday trading in both primary and secondary markets allows ETFs to be real-time price discovery mechanisms investors can easily access and trade no matter the underlying asset.

- Tax efficiency – The unique in-kind creation/redemption mechanism behind ETF shares allows ETFs to more effectively manage tax risks by washing out low cost basis securities overtime, minimizing chances of issuing capital gains distributions come tax season.

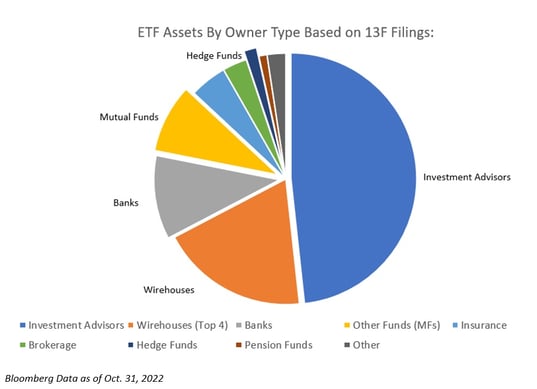

These benefits are the reason why the ETF structure has found a following among investor of all types, from large institutions to asset managers of all sizes to retail folks everywhere.

Of note, what’s not included in this pie chart above is the retail slice (or any investor type that’s not required to submit 13F filings.) According to the data, that slice should be about 33%, meaning that approximately one third of ETF adoption today is at the hands of retail investors.

Industry Growth Factors

As an industry, there are many benefits to being an ETF provider as well.

Beyond the consistently strong investor demand for ETFs – everyone wants to create a product that clients are clamoring for – there are real benefits to the business of being a provider.

- Operational Efficiency: streamline your business and outsource the details

ETFs allow you, the provider, to package your expertise in a single ticker and streamline your business. If you are an RIA, for example, you can create an ETF that deliver access to your investment expertise and offer that solution to clients across your book. Managing multiple separately managed accounts is time intensive and not scalable.

With an ETF instead of multiple SMAs, you can then outsource back-office operations, portfolio management and trading – all of the day-to-day tasks of keeping an ETF running – with tech solutions as well as industry participants (operators, custodians, traders.)

Conversations with clients also can be simplified. Communicating results and managing investment expectations is more difficult at a single account level, but with an ETF, transparency allows for easy portfolio-based conversation and assessment of results. Compliance and trade execution management are also simplified with a single ETF.

If you’re an asset manager who runs a mutual fund, the path to ETFs is now easier following the adoption of Rule 6c-11, the “ETF Rule” which opens the door to conversions. You can now convert your mutual fund strategy into an ETF and preserve the existing investment objective, track record and performance history as well as the board of directors from your mutual fund. The conversion should not be a taxable event.

- Access New Audiences: Expand your reach and distribution channels

ETFs are listed as stocks in exchanges across the country and available across multiple platforms. By design, ETFs reach anyone interested in what they offer, whether that investor is in your client book or whether they find that ticker through a brokerage account.

That means ETFs can expand your existing reach, whether you are an RIA, an asset manager, a hedge fund manager, a family office, or even an entrepreneur.

If you run a mutual fund, by launching an ETF of your strategy you may find a whole new following among investors who are looking for intraday trading.

If you run a hedge fund, for example, you typically transact among high net worth accredited investors, but an ETF can broaden that reach into the advisor, retail, intermediary and potentially institutional spaces because ETFs are typically lower cost, liquid, easy to access and trade through brokerage accounts.

If you are an entrepreneur who is an expert in a certain field, through an ETF you can make that expertise or that theme investable. The ETF makes your expertise now easily accessible to anyone.

By launching an ETF you can not only reach a massive audience across retail, advisor, intermediary and institutional channels, but you can also broaden your reach in the form of product line completion. By expanding your offering, you are expanding your access to new segments, and possibly relying on ETFs as the gateway strategy to an upsell opportunity down the line.

- Branding: Make your expertise known

The ETF market includes major global financial services firms. By launching ETFs, you are putting your business in the same turf as JP Morgan, Goldman Sachs and Vanguard among many others.

As of November 2022, there were 270 different ETF providers in the U.S. offering more than 3,070 ETFs. The industry has welcomed 50 new providers in the past 12 months and launched roughly 3 ETFs to each one it closes, according to our data. Competition is definitely steep.

But so is the opportunity to bring to market unique expertise or a new idea packaged in an ETF. By launching an ETF, you can make that expertise or idea investable and accessible, tying your brand to a memorable ticker that’s available to investors in and beyond your existing client book.

The broad, democratizing reach of the ETF market means your brand and your expertise can be at everyone’s fingertips, competing for the same investor dollars whether you are a JP Morgan or a small brand-new firm.

- Tax Efficiency: Better tax management for your clients

The creation/redemption mechanism unique to ETFs allows the funds to be far more tax efficient than mutual funds and other investment products.

Any given year, according to various data providers, less than 10% – and often less than 5% – of all ETFs issue capital gains distributions. That’s because ETFs can rely on Authorized Participants to be thoughtful when creating/redeeming ETF shares and unload low-cost basis securities through custom baskets throughout the year, effectively washing out capital gains overtime, making distributions a rare occurrence.

SMAs, for that same benefit, require a lot of optimizations. Mutual funds and hedge funds can’t do that at all.

Clients invested in ETFs only pay taxes when they exit the fund. They don’t face a tax event associated with actions from other shareholders, as they may in mutual funds. If you are the product provider offering mutual funds, consider that through an ETF your clients should not be faced with a surprise tax bills on gains tied to another investor’s sale of a position – that’s a real benefit. As a hedge fund manager, ETFs can allow you to offer a more tax efficient version of your hedge fund strategy.

Taxes matter, and when it comes to offering investors and clients tax efficiency, ETFs do it best compared to other commingled fund structures.

ETFs for Better Outcomes

There are challenges associated with ETFs for both investors and product providers. For one, while we see ETFs as a great democratizer of market access, actually accessing ETFs require a brokerage account. You can’t buy an ETF directly from its provider, which is neither good nor bad, but we can be a challenge, and it’s certainly different from mutual funds and hedge funds. For providers, that makes distribution a crucial hurdle ETFs have to overcome to deliver their reach potential.

Some have also argued that portfolio transparency – one of the beloved hallmarks of ETFs – can be detrimental to managers looking to capture alpha in market inefficiencies, or to, say, Family Offices that may see too much disclosure as more reputational risk than reward.

ETFs aren’t the end all be all. But, by and large, there are many benefits to owning and to launching ETFs, which is why we continue to see this market grow in number of funds, number of participants and number of assets. From newcomer to well-established strategy, ETFs today are go-to solutions for all sorts of market access objectives.

If you have a brilliant new idea or a new take on a market segment or theme, why not launch an ETF?

Disclosure

All investments involve risk, including possible loss of principal.

This material is provided for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).

Topics: Weekly Research