“What we need is a no-load, minimum management-fee mutual fund that simply buys the hundreds of stocks making up the broad stock-market averages and does no trading from security to security in an attempt to catch the winners. Whenever below-average performance on the part of any mutual fund is noticed, fund spokesmen are quick to point out “You can’t buy the averages.” It’s time the public could. ….there is no greater service [the New York Stock Exchange] could provide than to sponsor such a fund and run it on a nonprofit basis…. Such a fund is much needed, and if the New York Stock Exchange (which, incidentally, has considered such a fund) is unwilling to do it, I hope some other institution will.”

– Dr. Burton Malkiel, A Random Walk Down Wall Street 1973

With these words, Burton Malkiel forever changed the business of security indexation. Although the NYSE did not listen to his advice, John Bogle did and Vanguard launched the first index mutual fund in 1975. Almost 40 years later, indexation represents 10% to 20% of all investing and with the massive, ever-growing pool of ETFs this percentage is likely to grow significantly.

Toroso believes this growth creates both opportunities and pitfalls for ETF investors, and the key to success or failure in ETF investing lies in understanding index construction. Simply put, the democratization of the market, as envisioned by Malkiel and Bogle, is nearly complete; however, the transition of indexing from a benchmarking tool to an asset-gathering tool has possibly tarnished many of the benefits indexing provides for the average investor and created significant opportunities for the savvy investor.

Traditional Indexes and Float Adjustment

The index measurement world has traditionally been dominated by ranking index constituents by market capitalization. The first US listed ETF, SPDR® S&P 500 ETF Trust (SPY), which recently celebrated its 20th anniversary, is a market cap weighted index. The success of SPY and many other ETFs that followed prompted a significant change in weighting methodology, which began in 2006. The new methodology focused on market capitalization but adjusted the weighting for float, which meant companies with substantial insider ownership were allotted lower weights in the index.

Consider the following chart:

Therefore, products associated with these indexes can handle more assets because the product is not required to buy as many shares of stocks with substantial insider ownership and simplified their ability to fill these purchase orders. In other words, without float adjustment the size of the ETF may hit a ceiling or need to be capped.

The result of this change meant that many of the large index providers realized the scalability and profitability of their asset management/gathering business far outpaced their original revenue streams from licensing a benchmarking tool. Consequently, creating an index became a fast growing adjunct business to developing ETFs and new index providers entered the market to partner with ETF providers. And float adjustment opened the door to potentially higher volatility of the index itself. But the real benefit is the ability to handle significant volume with reduced efforts and thereby create profits for the providers.

Narrower Indexes or Sharp Knives

The next wave of indexes targeted sectors, geographic regions, different market caps, growth and value style categories, or simple geometric alternatives like equal weighting. All of these have experienced huge success in asset gathering but have not always offered investors the desired/expected market exposures.

For example, the sectors are often dominated by a few companies; market cap indexes overweight the largest rendering the smaller companies insignificant; the growth and value indexes have massive overlaps in holdings and returns; and finally the equal weighted indexes often have no benefit when compared to similar average market caps.

Granted these statements are generalizations, and many sophisticated investors have successfully navigated these issues to profitable trades. The point is not that these are bad products because they are designed to raise money; rather the key is to understand the index methodology so one can invest in the targeted exposure, and hopefully enhance the return of the overall portfolio.

The Knives Get Sharper

Two waves of fundamental indexation came next. The first was dividend or revenue weighting. These ETFs, from sponsors like WisdomTree and RevenueShares, started with slow growth, but more recently were able to capitalize on the low interest rate, yield starved market environment. These weighting schemes represent clear value for investors in certain economic cycles but they are not necessarily buy and hold vehicles, as some marketing departments would have you believe. For more information on the right time to hold these types of ETFs refer to “Toroso Commentary September 2013 Small Caps: What do you own?”

PowerShares pioneered the second part of fundamental indexation through their RAFI methodology, which quickly found competition from First Trust and their AlphaDex series. Both of these methods focus on a number of fundamentals like Cash Flow, Book Value and Sales.

In sideways or non-directional markets these ETFs have produced superior risk adjusted returns since these are the markets when fundamentals matter. During strong bull and/or bear markets these ETFs have provided much less value, possibly due to expenses which can be two to five times the cost of traditional beta ETFs, and secondarily the delinking of the underlying fundamentals in a momentum driven market.

The Knives Lose Precision

The obvious next step was to move into active ETFs and leave the index behind. Without having an index to follow, the provider is given wider latitude in determining which securities will make up the basket for the ETF. Selling these ETFs has proven much more difficult than most market professionals expected. Passive ETFs have been primarily viewed as tools to get precise exposures; whereas active mutual funds have been sold on incentives and performance, even though every piece of financial marketing material includes a disclosure warning that “past performance is not an indication of future results.”

Active ETFs, like passive ETFs, have no way to provide incentives so they rely solely on performance and a good story or brand. Unfortunately, ETFs require volume to succeed as well; most investors will not purchase an ETF that trades only a few thousand shares a day no matter how superior the relative performance. So despite a few notable exceptions from companies like PIMCO, active ETFs have yet to truly succeed as asset gathering vehicles or investment tools for the masses. We believe it will take some time for active ETFs to gain a significant foothold in the space.

The “Experts Only” Category

Now let’s discuss path dependent ETFs, which includes leveraged, inverse, futures based commodities and/or volatility. We use the term path dependent because these are almost always guaranteed to be poor long-term investments.

For example, the leveraged ETF sponsor ProShares has raised through net creations close to $80 billion in assets yet currently oversees about $26 billion in ETFs. This comes from the nature of a daily reset index in a volatile environment. Simply put, the structure of these indexes causes compounding to work against the investor in non-directional environments; so in theory, as well as practice, one could own equal positions in the two times long ETF and two times short ETF and still lose a significant percentage of money.

The same phenomenon can occur in futures based commodity ETFs or the Chicago Board Options Exchange Market Volatility Index (VIX) focused ETFs but for different reasons. These structures often experience negative returns due to a concept known as contango, which is the difference between the cost of immediate exposure and future exposure. What this cost can be compared to is the storage and delivery cost of raw materials, which varies but can be quite expensive. For example, when utilizing ETFs to gain exposure to the VIX there is no physical delivery possible, so the contango is often very high.

iPath S&P 500 VIX Short Term Futures Exchange-traded Note (VXX) is by far the largest product in this space and tracks the VIX short-term futures index. Since its inception in 2008 it has annualized at negative 59% return. But when used as a trading strategy, there are possible gains to be realized. Toroso believes investors should carefully employ these ETFs as either short-term trades or longer-term shorts.

The Current Frontier of ETFs

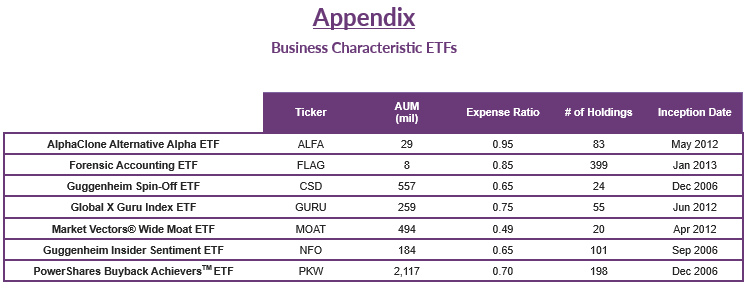

Perhaps the most interesting form of an index as an ETF focuses on business characteristics. No ETF sponsor has focused on this methodology exclusively but a selected few have issued some ETFs. These ETFs strive to identify a characteristic of a business that should perform well in certain economic cycles. This includes companies that are buying back shares, companies with high relative insider buying, spin-offs, companies that have conviction buying from hedge funds and companies that exhibit high barriers to entry or long product life-cycles. The Appendix below provides the list of ETFs that, to our knowledge, make up this category.

These indexes allow investors to target the characteristics that active mutual fund and hedge fund managers look for in an equity but do so in a more diversified way. They also provide access to characteristics that may provide future growth or value exposure, rather than focusing on companies that have traditionally fit those categories. Using these ETFs in a portfolio may provide unique benefits typically missed in strategies built on the asset classes of modern portfolio theory.

In Conclusion

Toroso believes ETF investing is not about filling points along the efficient frontier, but about solving for objectives within a portfolio. That is why we may employ any of these index methodologies at a certain time in the economic cycle. We believe in looking for the ETF with the best exposure that meets our clients’ investment objective.

Disclosure

All investments involve risk, including possible loss of principal.

This material is provided for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).