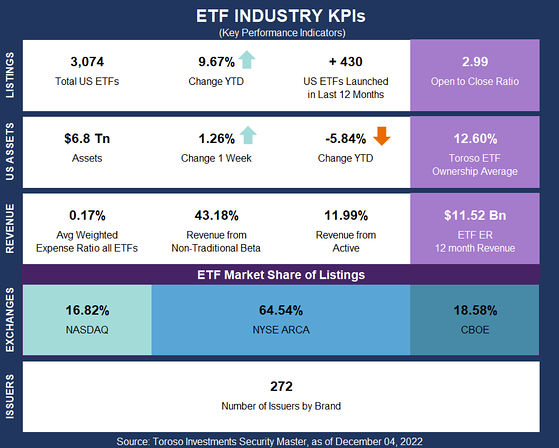

Week of November 28, 2022 KPI Summary

- This week, the industry experienced 7 ETF launches and 5 closures, shifting the 1-year Open-to-Close ratio to 2.99 and total US ETFs to 3,074.

- Another positive week for ETF assets, so let’s look at the industry progress and other data points that jump out.

- Total ETF assets reach $6.8 Trillion. Assets peaked at that height in our August 14 KPIs nearly 4 months ago, and again 4 months before that on April 17, 2022. We’ll see if this ceiling is broken over the next few weeks, but certainly noteworthy for these 4-month potential peaks.

- As we have been reporting all year, the open-to-close ratio has been slowly falling from 5.77 eight months ago to 2.99 currently (using the prior example date of April 17th). This has been due to a slight decrease in launches and a major uptick in closures.

- With the open-to-close ratio decreasing, so has the rate of new issuers in the ETF industry in 2022 thus far. There were 76 additional issuers in 2021, and only 26 YTD in 2022. Just like fund closures, issuers closures have been a cause of this decline as well. Growth is good, but growth with trimming excess fat in our industry is healthy.

- Our big news this week is our “ETF World Cup” article being released on Wednesday. As the bracket was set on Friday in the 2022 FIFA World Cup, we will use the same matchups and determine our winning country in the ETF World Cup. Each round will have a different scoring system to determine the winner. Check out our opening matchups below and let us know who you think should be moving on.

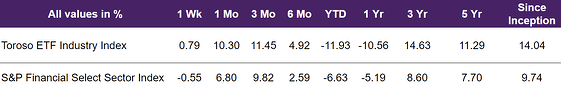

The tracked indexes had different experiences in the past week. The Toroso ETF Industry Index was up 0.79% while the S&P Financial Select Sector Index trailed at -0.55%.

ETF Launches

The Meet Kevin Pricing Power ETF (ticker: PP)

YieldMax Innovation Option Income Strategy ETF (ticker: OARK)

Nicholas Fixed Income Alternative ETF (ticker: FIAX)

ProShares S&P Global Core Battery Metals ETF (ticker: ION)

AllianzIM U.S. Large Cap Buffer10 December ETF (ticker: DECT)

AllianzIM U.S. Large Cap Buffer20 December ETF (ticker: DECW)

Main International ETF (ticker: INTL)

ETF Closures

Vanguard US Liquidity Factor ETF (ticker: VFLQ)

Ecofin Digital Payments Infrastructure ETF (ticker: ETPA)

Alpha Architect Merlyn.AI Tactical Growth & Income ETF (ticker: SNUG)

Inspire Faithward Large Cap Momentum ETF (ticker: FEVR)

Alpha Architect Merlyn.AI Best of Breed Core Momentum ETF (ticker: BOB)

Fund/Ticker Changes

None

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of December 2, 2022)

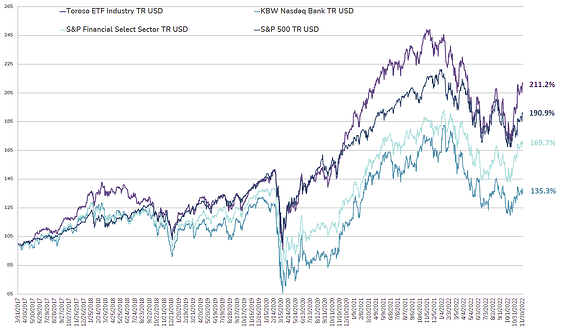

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through December 2, 2022)

Source: Morningstar Direct

Why Follow the ETF Industry KPIs

The team at Toroso Investments began tracking the ETF Industry Key Performance Indicators (KPI’s) in the early 2000’s and have been consistently reporting on, and analyzing these metrics ever since. The table above was the impetus for the creation of the TETF.Index, the index that tracks the ETF industry. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TEFT.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Toroso has gathered the information presented from sources that it believes to be reliable, Toroso cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Toroso’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.

Topics: ETF Industry KPI’s